Senior Tax Accountant

About Us

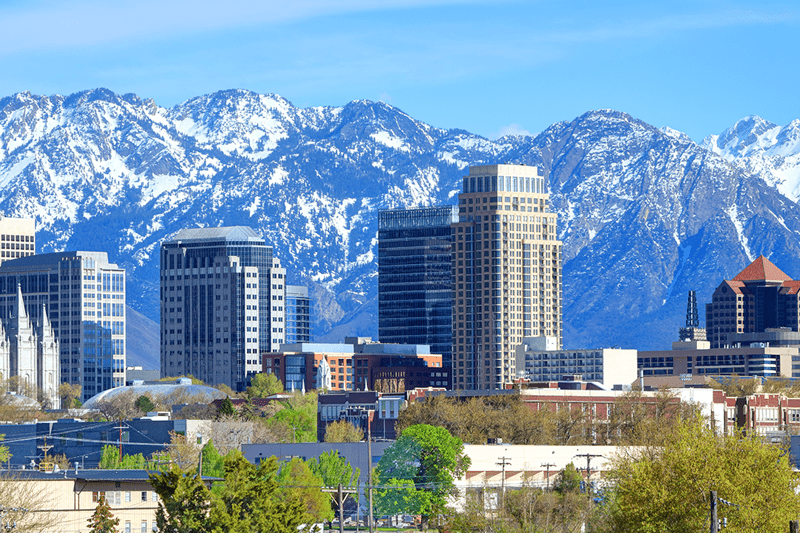

Hartle & Rees, is a reputable and growing tax firm that has been serving the Salt Lake City community since 1991. Our firm has extensive tax compliance and consulting experience with high net-worth individuals and closely held businesses in a variety of industries.

About the Role

We are seeking a detail-oriented Senior Tax Accountant to join our growing team. In this role, you will handle a variety of tax compliance and accounting responsibilities, from preparing individual and business returns to cleaning up and analyzing client books in QuickBooks Online. You’ll work closely with Tax Managers and Partners to understand each client’s unique needs, ensuring accurate filings, clear financial records, and proactive tax solutions. This position is a great fit for someone who enjoys balancing technical tax work with meaningful client interaction in a collaborative, supportive environment.

What’s in it for you:

- Flexible work schedule (Hybrid/Remote)

- Medical, Dental, and Vision benefits package

- 401(k) with company match

- Opportunity for career growth / path to Director or Partner

- A supportive culture to allow you to live a fulfilling, happy, and impactful life

Key Responsibilities:

- Prepare and file a variety of tax returns, including but not limited to Individual, C-Corp, and S-Corp returns, with minimal to no supervision

- General accounting and bookkeeping utilizing QuickBooks Online to analyze and clean up client books

- Assist Tax Managers and Partners in managing client relationships, including understanding client’s tax and business needs and gathering required information

- Research and identify tax issues to best serve clients’ needs

- Collaborate with leadership in coordinating large client engagements, identification of problems and providing solutions

Requirements

- Bachelor's Degree in Accounting preferred (or relevant years of experience)

- 3+ years of Tax Accounting experience

- Knowledge of Federal, State and Local tax codes and regulations

- Excellent interpersonal skills in working with staff and clients

- Active CPA license or CPA eligible (Preferred)

- Experience with leading tax software and QuickBooks

- Department

- Hartle & Rees

- Locations

- Murray

- Remote status

- Hybrid

About Baysora

At Baysora, we partner with boutique tax and accounting firms to protect what makes them unique while fueling their next chapter. Backed by patient family capital, we take a long-term approach that prioritizes people, culture, and client service. Joining our team means being part of a network that values autonomy, invests in growth, and creates clear pathways for future leaders.